Article by Top Producing Realtor & Marketing Director Ken Grech, Troop Real Estate – Simi Valley, CA

According to Trulia.com and Zillow.com, the year 2014 is going to be taking a different spin in Real Estate than this last year in 2013.

2013 was the year of the Investor, 2014 will be the year of the Repeat Home Buyer!

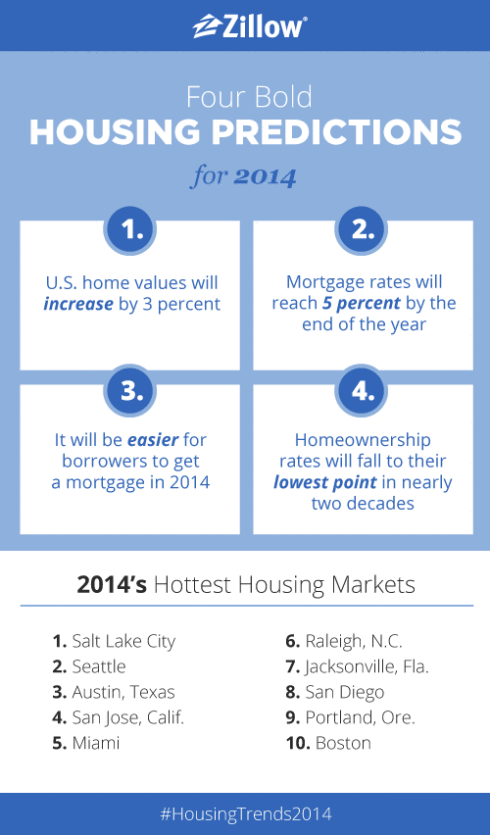

Zillow’s Prediction for the Housing Market in 2014

“A lot has changed in real estate in 2013. Home values have skyrocketed in many markets, mortgage rates have risen from their bottom and most recently, negative equity fell at the fastest pace ever.” – Zillow

Trulia’s Prediction for the Housing Market in 2014

Here are 5 ways that the 2014 housing market will be different from 2013:

-

-

Housing Affordability Worsens. Buying a home will be more expensive in 2014 than in 2013. Although home-price increases should slow from this year’s unsustainably fast pace (see #4, below), prices will still rise faster than both incomes and rents. Also, mortgage rates will be higher in 2014 than in 2013, thanks both to the strengthening economy (rates tend to rise in recoveries) and to Fed tapering, whenever it comes. The rising cost of homeownership will add insult to injury in America’s least affordable markets: in October 2013, for instance, 25% or less of the homes listed for sale in San Francisco, Orange County, Los Angeles, and New York were affordable to middle class households. Nonetheless, buying will remain cheaper than renting. As of September 2013, buying was 35% cheaper than renting nationally, and buying beat renting in all of the 100 largest metros. However, prices and mortgage rates might rise enough to tip the math in favor of renting in a couple of housing markets – starting with San Jose.

-

The Home-Buying Process Gets Less Frenzied. Home buyers in 2014 might kick themselves for not buying in 2013 or 2012, when mortgage rates and prices were lower, but they’ll take some comfort in the fact that the process won’t be as frenzied. There will be more inventory on the market next year, partly due to new construction, but primarily because higher prices will encourage more homeowners to sell – including those who are no longer underwater. Also, buyers looking for a home for themselves will face less competition from investors who are scaling back their home purchases (see #3, below). Finally, mortgages should be easier to get because higher rates have slashed refinancing activity and pushed some banks to ramp up their purchase lending. Moreover, the new mortgage rules coming into effect in 2014 will give banks better clarity about the legal and financial risks they face with different types of mortgages, hopefully making them more willing to lend. All in all, more inventory, less competition from investors, and more mortgage credit should all make the buying process less frenzied than in 2013 – for those who can afford to buy.

-

Repeat Buyers Take Center Stage. 2013 was the year of the investor, but 2014 will be the year of the repeat home buyer. Investors buy less as prices rise: higher prices mean that the return on investment falls, and there’s less room for future price appreciation. Who will fill the gap? Not first-time buyers: saving for a down payment and having a stable job remain significant burdens, and declining affordability is also a big hurdle for first-timers. Who’s left? Repeat buyers: they’re less discouraged by rising prices than either investors or first-time buyers because the home they already own has also risen in value. Also, the down payment is less of a challenge for repeat buyers if they have equity in their current home.

-

|

Biggest Obstacle to Homeownership |

||

|

All adults |

18-34 year-olds only |

|

| Saving enough for a down payment |

55% |

58% |

| Not having a stable job |

36% |

43% |

| Having a poor credit history |

35% |

33% |

| Qualifying for a mortgage |

32% |

29% |

| Unable to pay off existing debt |

26% |

30% |

| Rising home prices |

22% |

23% |

| Rising mortgage rates |

15% |

18% |

| Limited inventory |

5% |

5% |

| Among renters who wish to buy a home right now. Respondents could choose multiple options. Survey conducted November 2013. | ||

-

How Much Prices Slow Matters Less Than Why And Where. Prices won’t rise as much in 2014 as in 2013. The latest Trulia Price Monitor showed us that asking home prices rose year-over-year 12.1% nationally and more than 20% in 10 of the 100 largest metros. But it also revealed that these price gains are already slowing sharply in the hottest metros. How much prices slow matters less than why. If prices are slowing for the right reasons, great: growing inventory, fading investor activity, and rising mortgage rates are all natural price-slowing changes to expect at this stage of the recovery. But prices could slow for unhealthy reasons, too: if we have another government shutdown or more debt-ceiling brinksmanship, a drop in consumer confidence could hurt housing demand and home prices. Where prices change matters, too. Slowing prices are welcome news in overvalued or unaffordable markets, but markets where prices are significantly undervalued and borrowers are still underwater would be better off with a year or two of unsustainably fast price gains.

-

Rental Action Swings Back Toward Urban Apartments. Throughout the recession and recovery, investors bought homes and rented them out, sometimes to people who lost another (or the same!) home to foreclosure. In fact, the number of rented single-family homes leapt by 32% during this period. Going into 2014, though, investors are buying fewer single-family homes; loosening credit standards might allow more single-family renters to become owners again; and fewer owners are losing homes to foreclosures to begin with – all of which mean that the single-family rental market should cool. At the same time, multifamily accounts for an unusually high share of new construction, which means more urban apartment rentals should come onto the market in 2014. Urban apartments will be the first stop for many of the young adults who find jobs and move out of their parents’ homes. In short, 2014 should mean more supply and demand for urban apartment rentals, but slowing supply and demand for single-family rentals. Ironically, economic recovery means that the overall homeownership rate will probably decline, as some young adults form their own households as renters. Still, the shift in rental activity from suburban single-family to urban apartments would be yet another sign of housing recovery.

Make 2014 YOUR Year in the Housing Market

Let me help you make 2014 YOUR Year in the Housing Market. Whether you are a first time Home Buyer, a Repeat Home Buyer or an Investor, I am here to help! Please feel free to contact me at any time.

Happy Holidays and Happy New Year!

Ken Grech

Troop Real Estate

805-217-1368

www.SimiIsHome.com

[email protected]

Ken Grech

Troop Real Estate

805-217-1368

www.SimiIsHome.com

[email protected]

Explore Simi Valley Neighbourhoods

EXPLORE LOCAL NEIGHBOURHOODS IN Simi Valley