The Lawyers Title Preliminary ReportThe Lawyers Title Preliminary Report is an offer to issue a policy of title insurance covering a particular estate or interest in land subject to stated exceptions. Since these exceptions may point to potential problems with an intended purchase, it is important for all parties to review the report once it is received.“Since these exceptions may point to potential...

This chart is for reference purposes only. How title is vested has important legal consequences, and this chart should not be relied upon to make that decision. You should consult an attorney and/or CPA to determine the most advantageous form of ownership for your particular situation. Someone who is not an attorney cannot give advice regarding how to hold title because doing so would...

What is title insurance?A title insurance policy protects your legal rights over the property, occupancy, use, control, and disposition of the property.Why is it different to transfer title to property than it is to transfer different kinds of items such as a car?The transfer of property can be complicated because land is permanent but its use and the rights to use it can change over the years.What is a...

TAXES: These are usually standard, showing the status of the current tax year.RED FLAG: Postponed property taxes. This is a state program for senior citizens. It allows the owner to postpone the taxes until the property is sold or refinanced. The owner applies to the state, and the state provides “checks” thatthe owner uses to pay the taxes. This is a red flag because escrow will need to order a demand...

The dream of home ownership remains one of the most important goals for many people. Unfortunately, real estate scams can steal these dreams and have a serious, long-lasting impact on the victims.Anyone can become a victim to real estate fraud. Below are examples of the most common types of real estate fraud. Keep in mind there may be completely legitimate real estate transactions with similar...

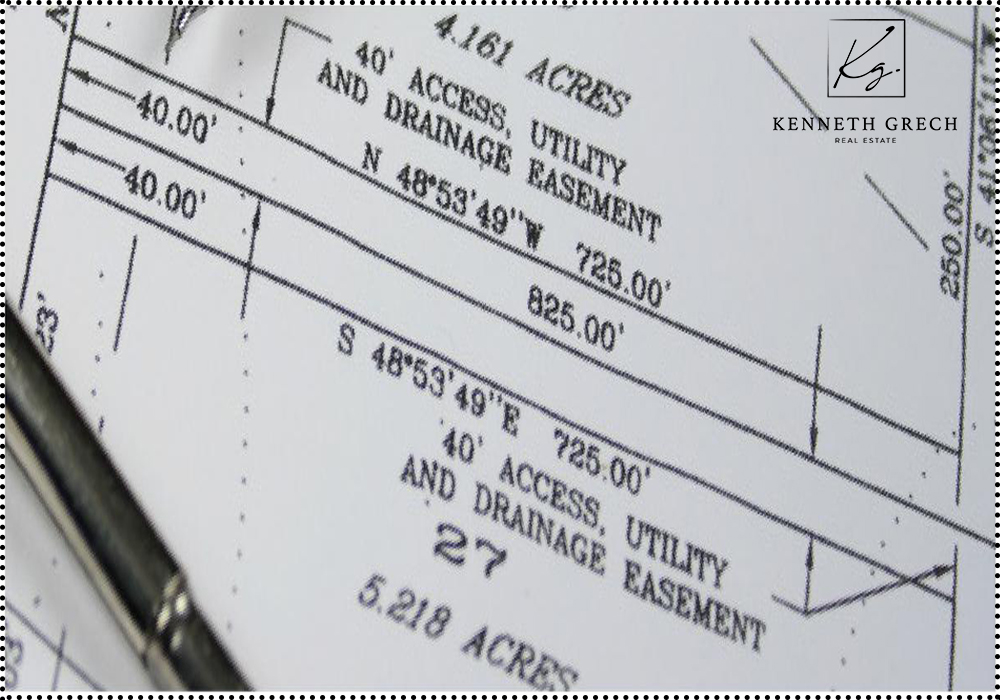

An easement is an interest in the land of another which entitles the owner of such interest to a limited use or enjoyment of the land in which the interest exists.In owther words the right to use the real property of another without possessing it. The essential qualities of an easement are:An interest in land and usually created by grant or agreement and generally must be transferred and used subject to...

Everyone has a will or plan, whether created or by default. Even if you have not made out a will or a trust, you still have a plan – a plan dictated by the laws of the state where you reside upon your death. Making a will is not a way to avoid “probate”, the court procedure that changes the legal ownership of your property after your death. Probate makes sure it is your last valid will, appoints the...

Supplemental Property Tax DefinedState law requires the Assessor to reappraise property upon change in ownership or completion of new construction.Types of changes in ownership are those changes involving a buyer and seller. However, change in ownership situations also include removing or adding someone’s name from title even if money is not exchanged.Typical new construction events include adding square...

What are Propositions 60 and 90?Propositions 60 and 90 are constitutional initiatives that provide property tax relief for persons age 55 and older. The propositions prevent reassessment when a senior citizen sells his/her existing residence and purchases or constructs a replacement residence worth the same or less than the original residence. This allows the senior citizen to continue to pay approximately...

What is a mello-roos fee?A Mello-Roos fee is a separate charge on a property tax bill in addition to the 1% property tax rate allowed by Proposition 13. The funds are used exclusively to pay for public facilities such as police and fire departments, schools, parks, roads and libraries, etc.How are mello-roos assessment fees established?Mello-roos fees are normally established at the request of a major...