Supplemental Property Tax Defined

State law requires the Assessor to reappraise property upon change in ownership or completion of new construction.

Types of changes in ownership are those changes involving a buyer and seller. However, change in ownership situations also include removing or adding someone’s name from title even if money is not exchanged.

Typical new construction events include adding square footage or a swimming pool. However, new construction also includes, but is not limited to, adding baths, fireplaces and air conditioning when they did not previously exist.

How Does The Assessor Discover A Change In Ownership Or Completion Of New Construction?

The Assessor generally discovers these events two ways:

- Changes in ownership are discovered through publicly recorded deeds;

- New construction is discovered when copies of building permits are sent to the Assessor’s Office. These bills are in addition to the regular annual tax bills.

How Will The Amount of My Bill Be Determined?

The supplemental assessment reflects the difference between the new assessed value and the old or prior assessed value. The Auditor-Controller calculates the supplemental property tax, and prorates it based upon the number of months remaining in the fiscal year in which the change of ownership or completion of construction occurred.

The fiscal year runs from July 1 through June 30. A change in ownership or new construction completion which occurs between January 1 and May 31 results in two supplemental assessments and two supplemental tax bills. The first supplemental bill is for the remainder of the fiscal year in which the event occurred. The second supplemental bill is for the subsequent fiscal year.

When and How Will I Be Billed?

The assessor will appraise your property and a Notice of Assessed Value Change will be mailed to you before supplemental tax bills are issued. At that time you will have the opportunity to discuss your valuation, apply for a Homeowner’s Exemption and be informed of your right to file an Assessment Appeal.

The County will then calculate the amount of the supplemental tax and the tax collector will mail you a supplemental tax bill. Supplemental tax bills are mailed directly to the property owner and are your responsibility. In general, they are not paid out of an impound account. Please check with your lender.

How Does The Proration Factor Work?

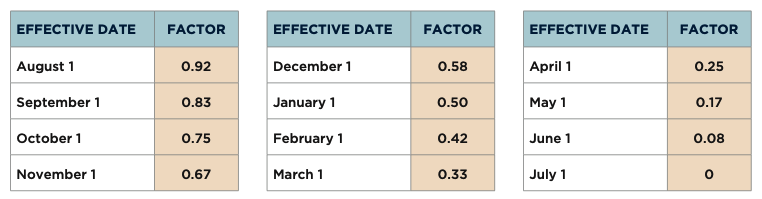

The supplemental tax becomes effective on the first day of the month after the month the change of ownership or completion of new construction actually occurred. If the effective date is July 1, then there will be no supplemental assessment on the current tax roll. In the event the effective date is not on July 1, then the table of factors below is used to compute the supplemental assessment on the current tax roll.

Example:

The County Auditor finds that the supplemental property taxes on your new home would be $1,000 for a full year. The change of ownership took place on September 15 with the effective date being October 1. The supplemental property taxes would, therefore, be subject to a proration factor of .75 and your supplemental tax would be $750.

Will My Supplemental Taxes Be Prorated in Escrow?

No, unlike your ordinary annual taxes, the supplemental tax is a one time tax which dates from the date you take ownership of your property or complete construction until the end of the tax year on June 30. Remember that supplemental tax bills are in addition to the regular annual tax bills. Supplemental bills go directly to the property owner, and not to an impound account.

Can I Pay My Supplemental Tax Bill in Installments?

All supplemental taxes on the secured roll are payable in two equal installments. The taxes are due on the date the bill is mailed and are delinquent on specified dates, depending on the month the bill is mailed, as follows:

- If the bill is mailed within the months of July through October, the first installment will become delinquent on December 10 of the same year. The second installment will become delinquent on April 10 of the next year.

- If the bill is mailed within the months of November through June, the first installment will become delinquent on the last day of the month following the month in which the bill is mailed. The second installment will become delinquent on the last day of the fourth calendar month following the date the first installment is delinquent.

Explore Simi Valley Neighbourhoods

EXPLORE LOCAL NEIGHBOURHOODS IN Simi Valley