California Mechanics’ Lien LawCalifornia law provides special protection to contractors, subcontractors, laborers and suppliers who furnish labor or materials to repair, remodelor build your home. The law allows contractors, subcontractors, laborers and suppliers to record a mechanics’ lien to ensure payment. If any of these people are not paid for the services or materials they have provided, the lien...

How Could It Affect My Closing? What Does “HERO” Stand For?HERO is an acronym for Home Energy Renovation Opportunity. HERO partners with local governments to make energy efficient, water efficient and renewable energy products more affordable for homeowners.Program EligibilityProgram eligibility requirements may vary in each city or county. In accordance with California law, the Program maintains...

Property Tax Defined Property tax is a tax administered by local government districts. Tax rates vary from county to county and are based on a predetermined percentage of an annually assessed value of each individual property. A tax rate includes a general 1% tax levy applicable to all bills, voter approved (pre-Proposition 13) special taxes, and voter approved debt issues for your...

The timeline displayed here is typical in a California non-judicial foreclosure. The foreclosure time line does not begin until the lender feels they have exhausted all avenues for curing the payment delinquency. Normally, this happens after the borrower has missed three monthly mortgage payments and the Notice of Intent to Foreclose has expired. The lender will try to contact the borrower several times...

An escaped assessment/tax bill may be the result of a reappraisable event that has not been reported to the Assessor’s Office. An example of such an event would be construction done without a building permit or an unrecorded transfer of ownership. An escaped assessment/ tax bill may also be the result of a business audit or a correction to an assessment. The most common example of an escaped assessment...

What is required prior to closing. If you hold title or will be taking title as a Corporation, please send the following:Articles of IncorporationBy-LawsResolution to sell or borrow (required to purchase)Certificate of Good Standing from Secretary of State (signatures must have two (2) Corporate Officers: President or Vice-President and Secretary or Treasurer. Less than two signatures will require a...

When a Change of Ownership Requires Reappraisal Joint TenancyUnder this method of holding title, each owner holds the property jointly with the other owners. Upon the death of one owner, the property passes to the surviving joint tenant. For assessment purposes, the termination of joint tenancy (other than husband and wife or parent/child transfers) causes a reappraisal.Tenancy In CommonUnder this method...

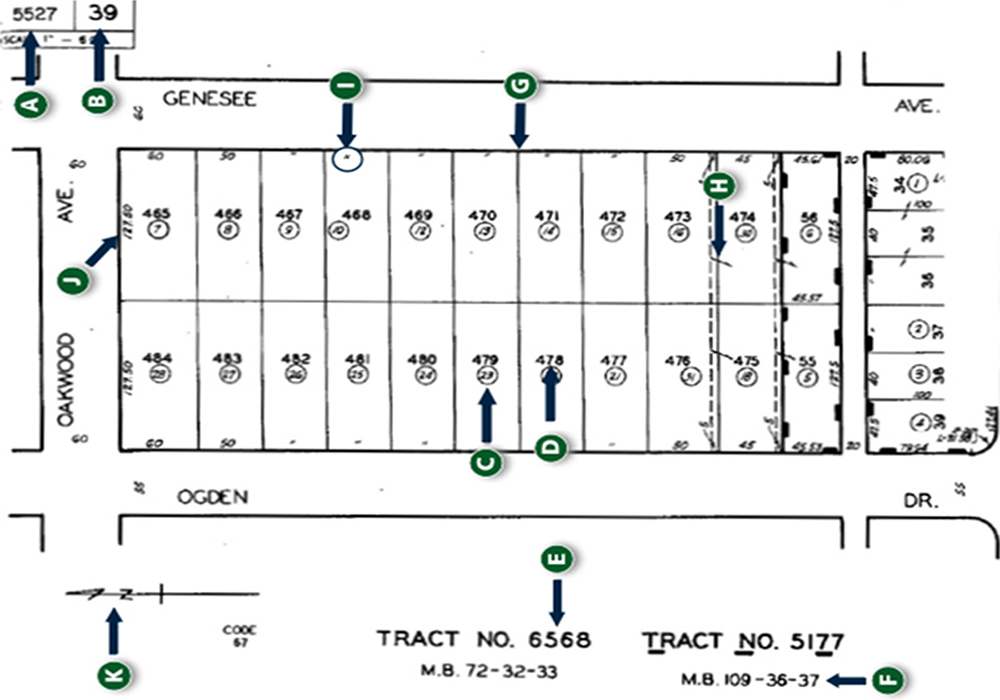

A. Assessor’s Book NumberFirst four numbers of the assessor’s parcel number (APN)B. Assessor’s Page NumberSecond three numbers of the assessor’s parcel number (APN)C. Assessor’s Parcel NumberThird three numbers of the assessor’s parcel number (APN). Always shown in a circle on the plat map.D. Lot NumberShows the subdivision lot number of the property. This number is never circled.E. Tract...

Impersonation of the true owner of the landForged deeds, releases, etc.Instruments executed under fabricated or expired power of attorneyDeeds delivered after death of grantor/grantee, or without consent of grantorDeeds to or from defunct corporationUndisclosed or missing heirsMisinterpretation of willsDeeds by persons of unsound mindDeeds by minorsDeeds by illegal aliensDeeds by persons supposedly single...

Explore Simi Valley Neighbourhoods EXPLORE LOCAL NEIGHBOURHOODS IN Simi Valley Auburn Lane VIEW MORE Auburn Hills VIEW MORE...